Metaplex DAO

Metaplex Protocol Revenue & $MPLX Buybacks

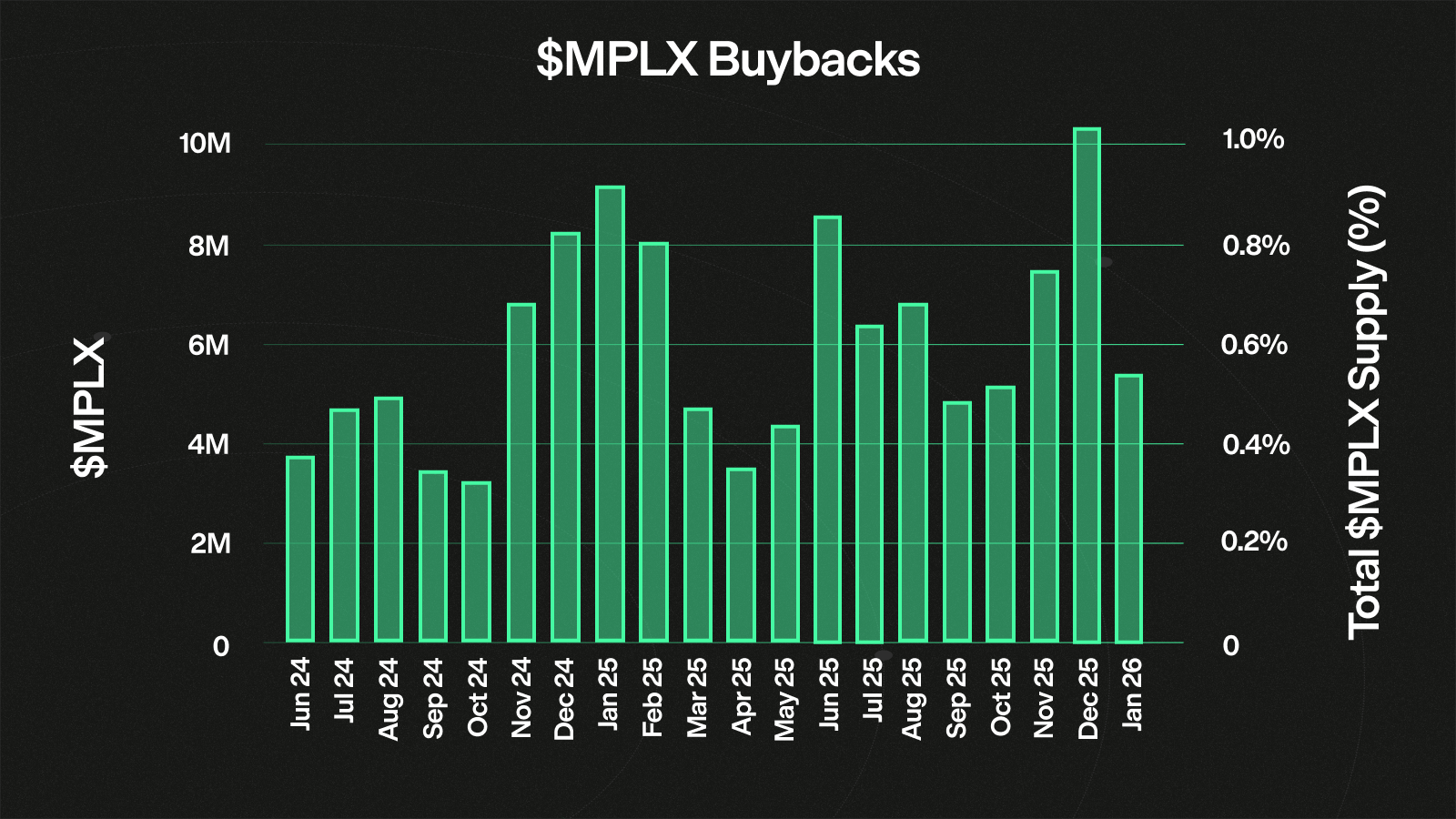

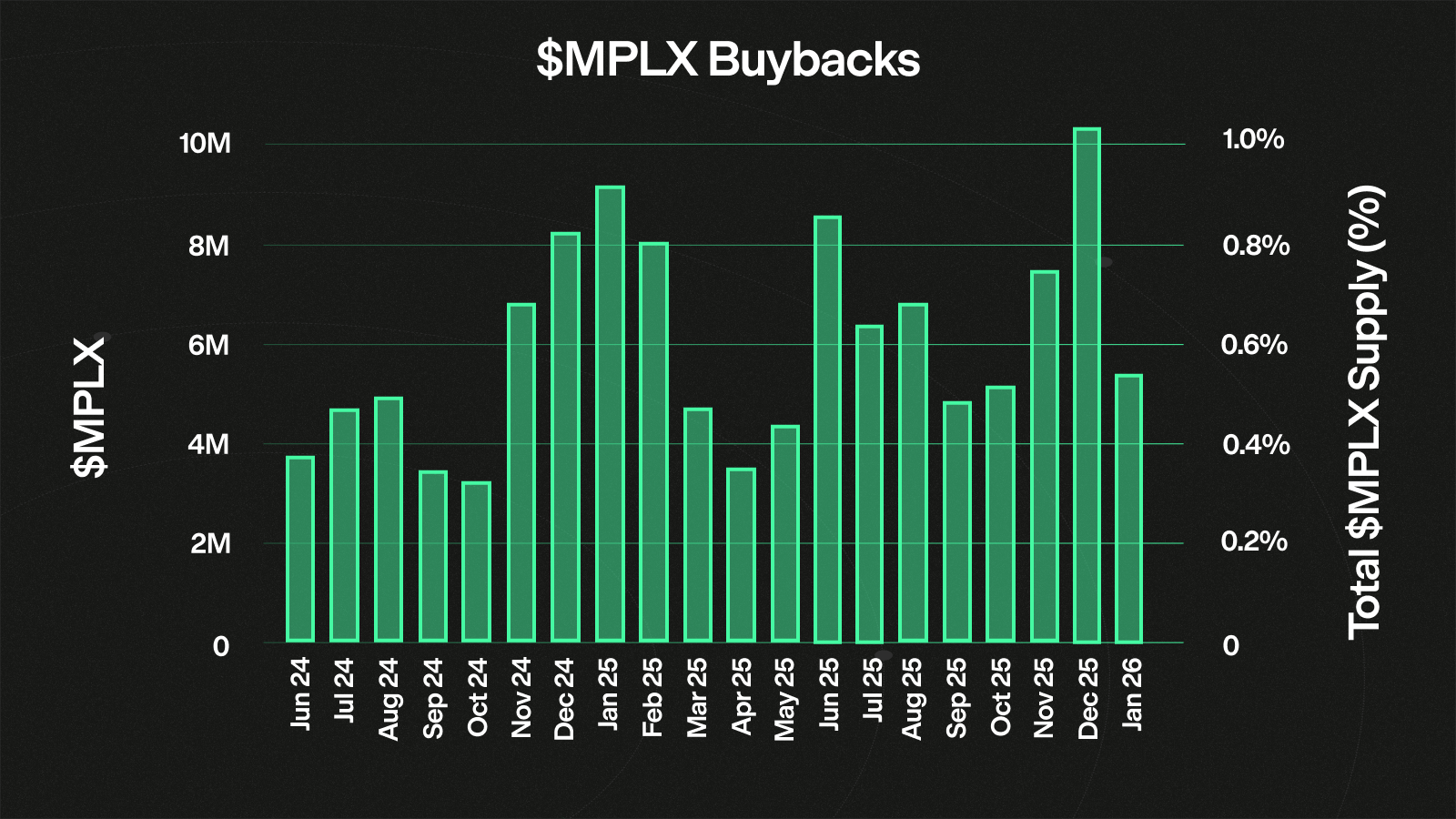

January’s buybacks reached 5.8M $MPLX as $239k of December's protocol revenue went towards buybacks for the DAO (0.6% of the total supply / 1% of outstanding supply). Each month, 50% of prior month’s protocol revenue is allocated to $MPLX buybacks for the DAO.

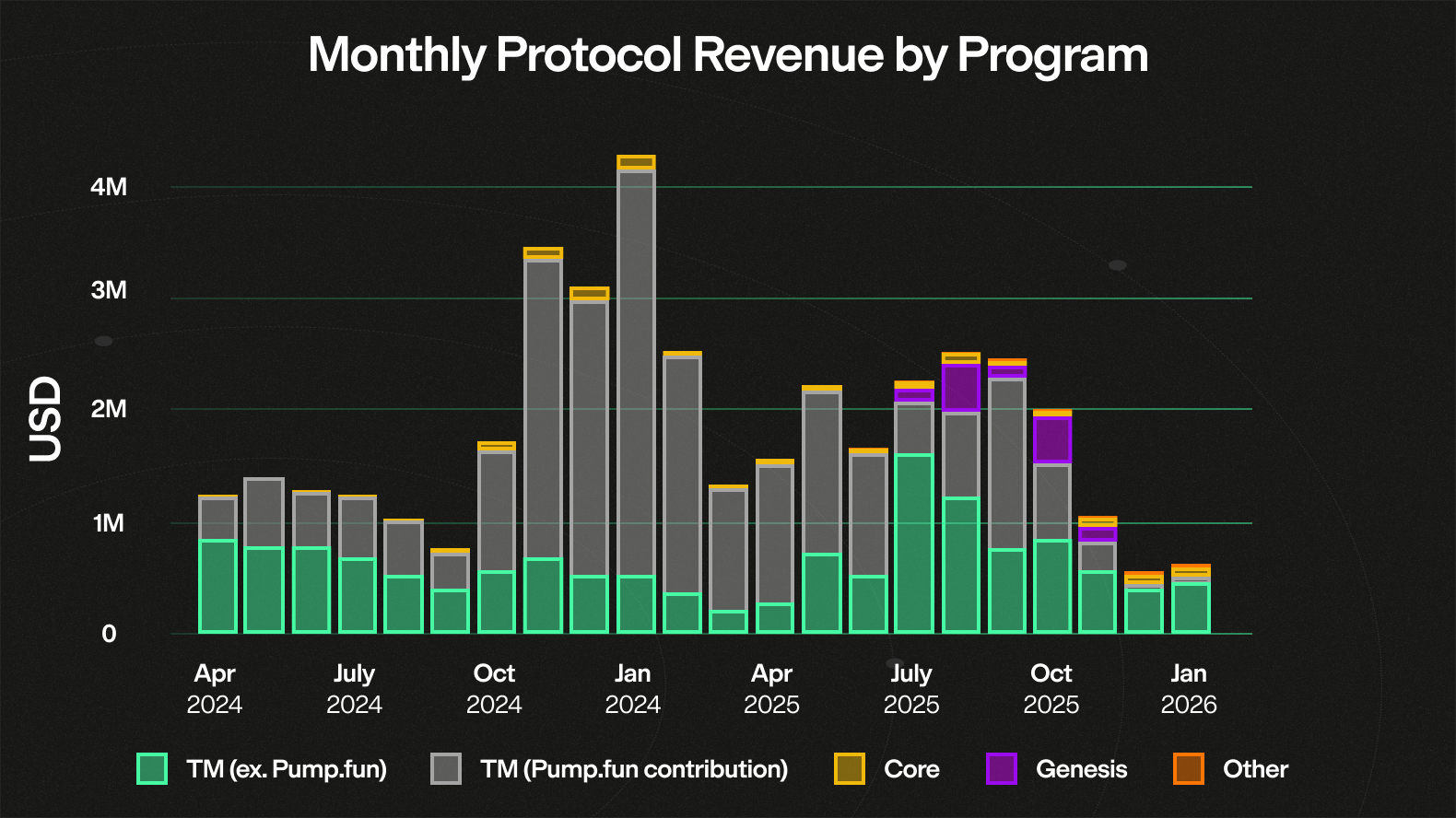

January protocol fees reached $608k USD (4,597 SOL), 50% of these fees will be used to buy back $MPLX for the DAO throughout January.

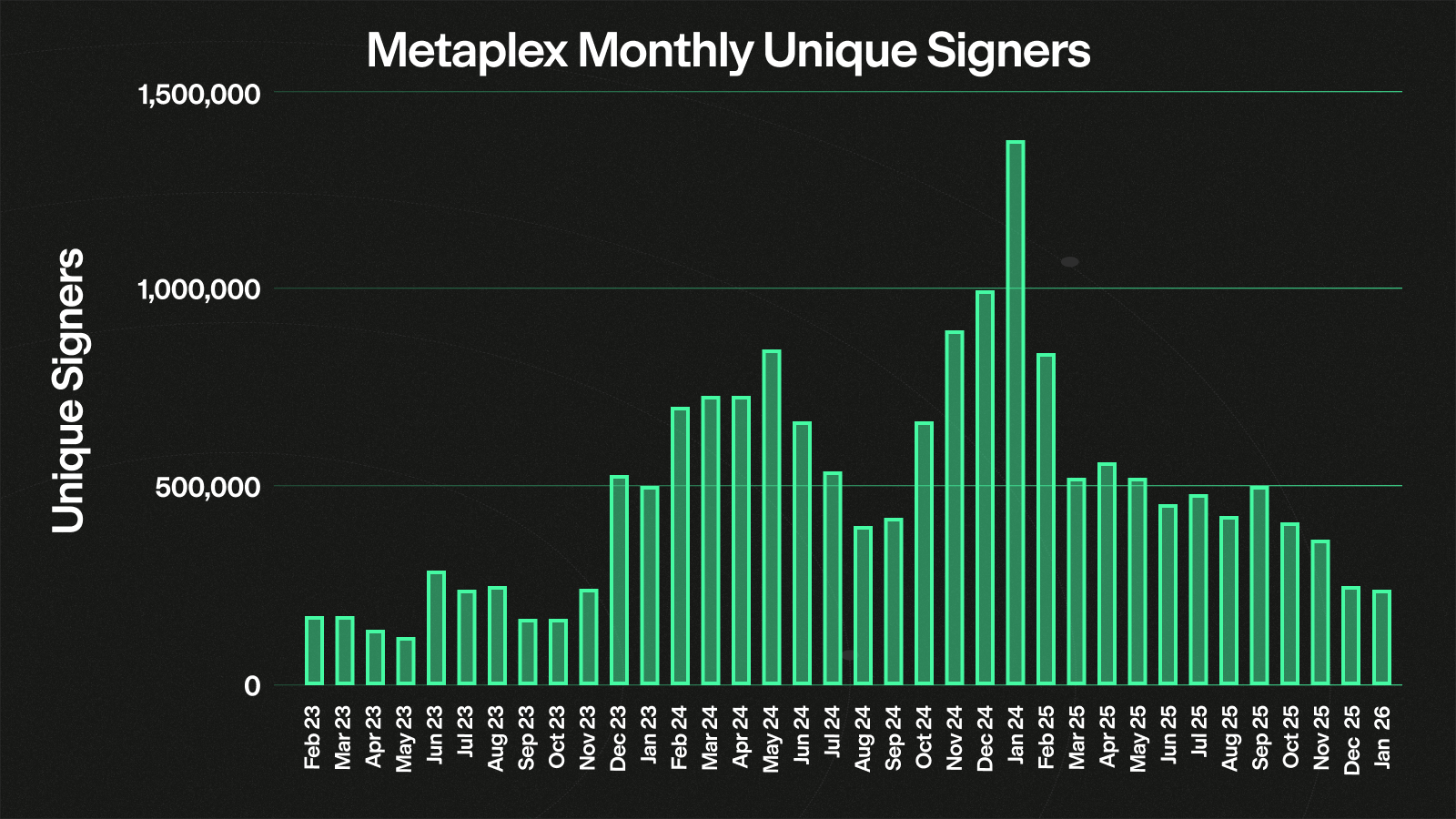

With cumulative protocol revenue approaching $48 million (318,525 SOL) to-date, Metaplex continues to scale while the DAO remains a key driver of governance, development, and ecosystem growth.

Metaplex Rewards Campaign

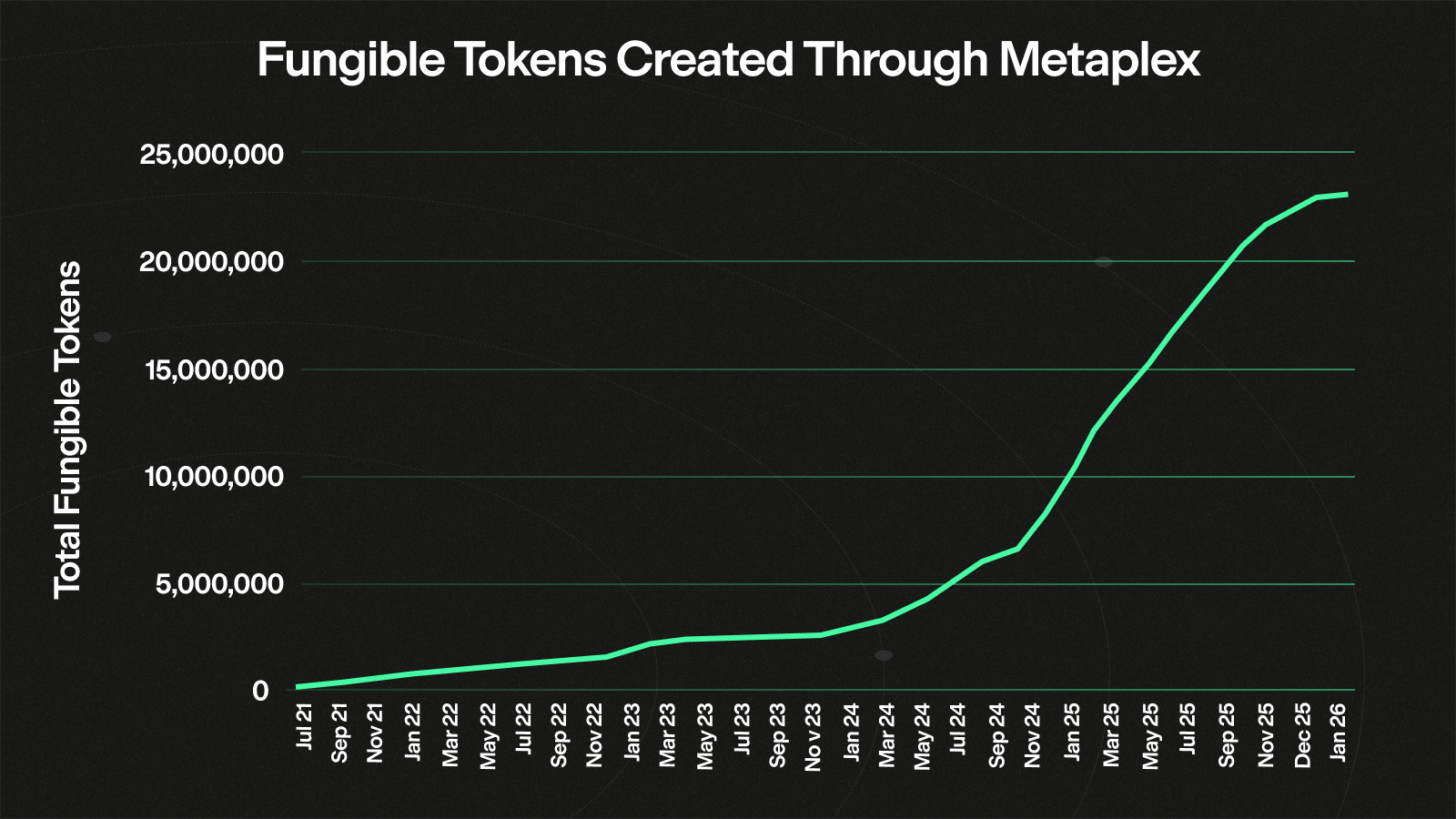

In January, a Metaplex DAO proposal submitted by Torque went live, seeking $250k worth of $MPLX to run a three-month “Season 1” growth campaign for projects launching tokens with Metaplex. The full allocation would be distributed directly to users via Torque’s analytics-driven incentive engine, with Torque covering all operational overhead and returning any unclaimed MPLX to the DAO. The campaign is designed to aggregate liquidity, improve post-launch retention, and generate onchain market intelligence to inform future Metaplex product and rewards strategy.

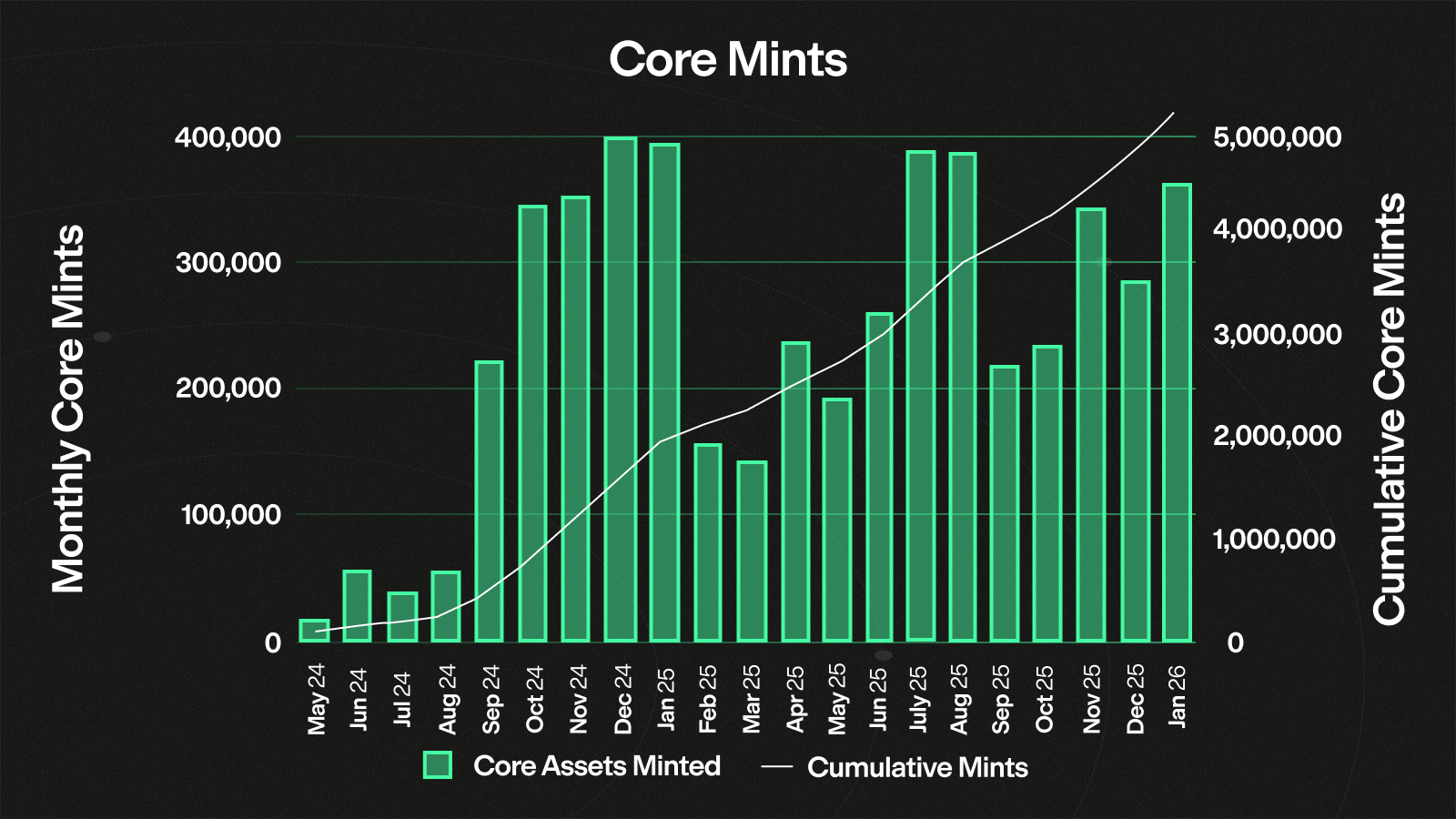

Earn Season 4 Campaign Passed

In January, the proposal by Forgd successfully passed, proposing to roll over 1,000,000 $MPLX of unused Season 3 rewards to fund a 4-month continuation of MPLX liquidity and adoption initiatives. The proposal does not request any new tokens from the DAO treasury, and positions Season 4 as a more capital-efficient phase with moderated LP incentives as trading fees make up a larger share of yield. In addition to maintaining Kamino vault liquidity, Forgd plans to activate a dedicated MPLX lending market on Kamino Lend v2 (previously deferred), expanding MPLX utility as onchain collateral while continuing the shift of price discovery and order flow onchain.

)

)